![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

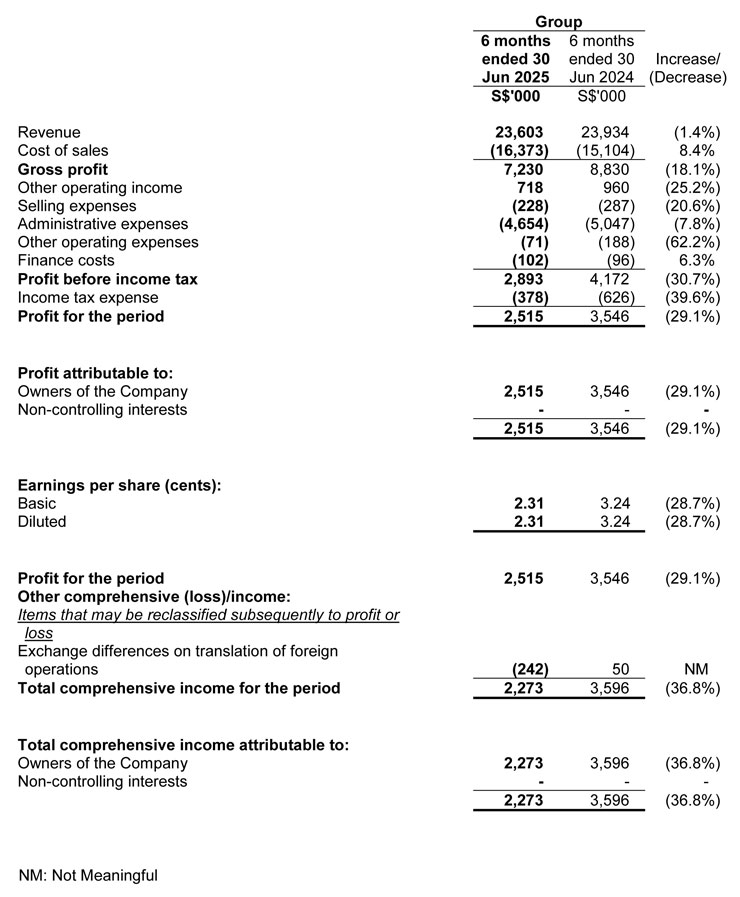

Consolidated Statement of Profit or Loss and Other Comprehensive Income

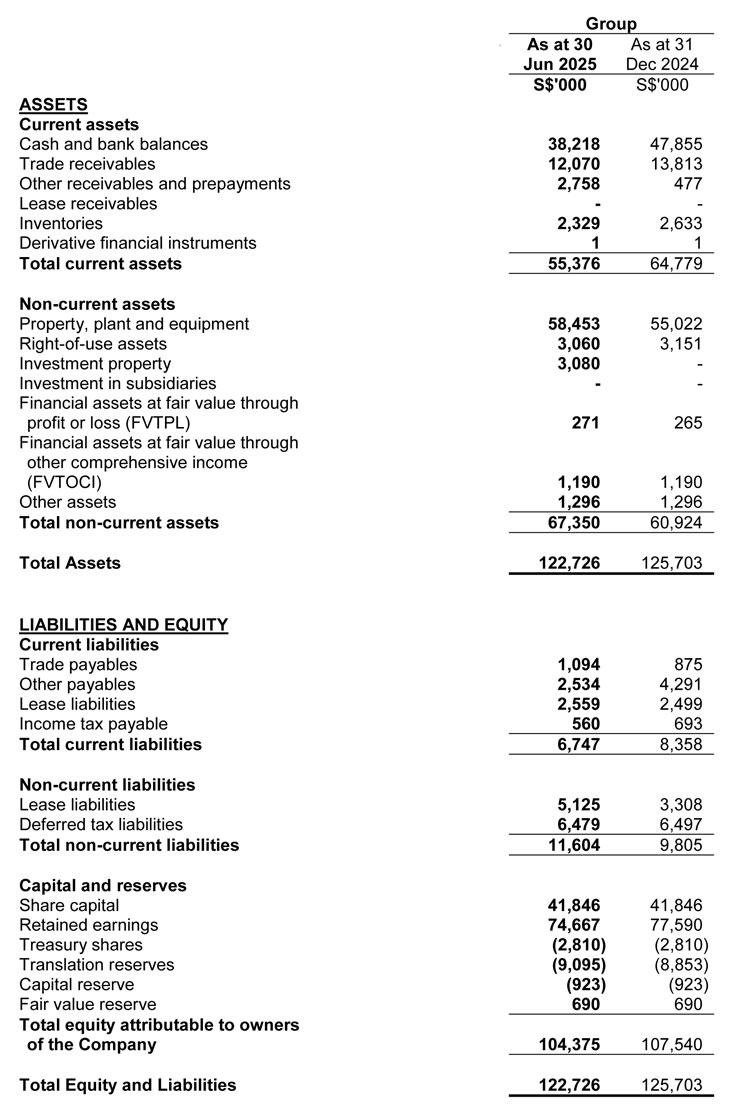

Condensed Interim Statements of Financial Position

Review of Performance

Income Statement

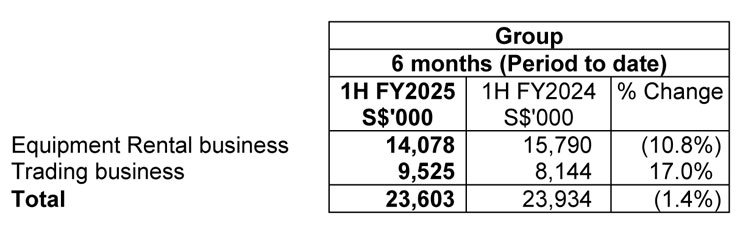

Revenue

The Group registered a total revenue of S$23.6 million in 1H FY2025, which was 1.4% lower than 1H FY2024. The decrease was mainly due to lower revenue generated in Equipment Rental business and was partially offset by an increased in Trading business.

Revenue from Equipment Rental business decreased by 10.8% to S$14.1 million in 1H FY2025 as compared to 1H FY2024. The decrease was mainly due to lower revenue contribution from Singapore segment.

Revenue from Trading business increased by 17.0% to S$9.5 million in 1H FY2025 as compared to 1H FY2024. The increase was mainly due to different product mix sold.

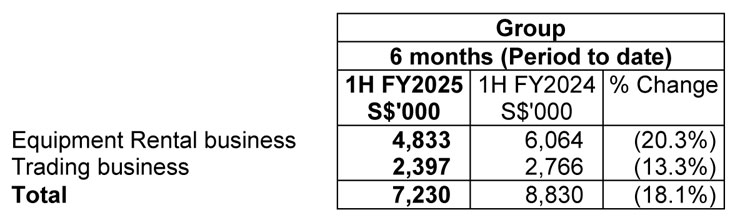

Gross Profit

The Group registered a total gross profit of S$7.2 million in 1H FY2025 which was 18.1% lower than 1H FY2024. The decrease was mainly due to lower revenue generated in Equipment Rental business and less than favourable gross profit margin from Trading business.

The Group registered a gross profit of S$4.8 million from Equipment Rental business in 1H FY2025, which was 20.3% lower than 1H FY2024. The decline in the gross profit from the Equipment Rental business was due to the decrease in revenue and higher associated costs.

The Group registered a gross profit of S$2.4 million from Trading business in 1H FY2025, which was 13.3% lower than 1H FY2024. The decrease was mainly due to less than favourable gross profit margin and different product mix sold.

Other Operating Income

Other operating income decreased by S$0.2 million in 1H FY2025 as compared to 1H FY2024. The decrease was mainly due to lower interest income and gain on disposal of property, plant and equipment, and was partially offset by higher foreign exchange gain.

Selling Expenses

Selling expenses decreased by S$0.1 million in 1H FY2025 as compared to 1H FY2024. The decrease was mainly due to the absence of sales commission payment in current period.

Administrative Expenses

Administrative expenses decreased by S$0.4 million in 1H FY2025 as compared to 1H FY2024. The decrease was mainly due to lower staff related costs.

Other Operating Expenses

Other operating expenses decreased by S$0.1 million in 1H FY2025 as compared to 1H FY2024. The decrease was mainly due to the absence of fair value loss for financial assets at fair value through profit or loss and lower mark-to-market loss on financial instruments in current period.

Finance Costs

Finance costs has largely remained flat in 1H FY2025 as compared to 1H FY2024.

Income Tax Expense

The Group recorded an income tax expense in 1H FY2025, mainly due to provision of current tax expenses for the period ended 30 June 2025, and adjustment for over-provision in prior years.

Statement Of Financial Position

Current Assets

As at 30 June 2025, current assets amounted to S$55.4 million or 45% of total assets. Current assets mainly comprise of cash and bank balances, trade and other receivables and inventories. Total current assets decreased by S$9.4 million as compared to 31 December 2024 mainly due to decrease in cash and bank balances, trade receivables and inventories, which was partially offset by increase in other receivables.

Non-Current Assets

As at 30 June 2025, non-current assets amounted to S$67.4 million or 55% of total assets. Non-current assets mainly comprise of property, plant and equipment and right-of-use assets. Total non-current assets increased by S$6.4 million as compared to 31 December 2024 mainly due to purchase of property, plant and equipment during the period.

Current Liabilities

As at 30 June 2025, current liabilities amounted to S$6.7 million or 37% of total liabilities. Current liabilities mainly comprise of trade and other payables, current portion of lease liabilities and income tax payable. Total current liabilities decreased by S$1.6 million as compared to 31 December 2024, mainly due to decrease in other payables.

Non-Current Liabilities

As at 30 June 2025, non-current liabilities amounted to S$11.6 million or 63% of total liabilities. Non-current liabilities comprise of the non-current portion of lease liabilities and deferred tax liabilities. Total non-current liabilities increased by S$1.8 million as compared to 31 December 2024, mainly due to increase in non-current portion of lease liabilities.

Working Capital

As at 30 June 2025, the Group registered a positive working capital of S$48.6 million as compared to that of S$56.4 million as at 31 December 2024.

Equity

As at 30 June 2025, the Group's total equity stood at S$104.4 million. Total equity decreased by S$3.2 million as compared to 31 December 2024, mainly due to payment of dividend, and was partially offset against profit for the period.

Statement Of Cash Flows

The Group's net cash used in operating activities in 1H FY2025 was S$3.3 million. This comprised positive operating cash flows before changes in working capital of S$5.2 million, and increase in net working capital flow of S$0.3 million and offset by the purchase of property, plant and equipment for rental use of S$8.3 million and income tax payment of S$0.5 million.

Net cash used in investing activities was S$10.1 million in 1H FY2025. This was due to the increase in fixed deposits with maturity of more than 3 months of S$7.5 million and cash outlay for the purchase of investment property of S$3.1 million, offset by the interest received of S$0.5 million.

Net cash used in financing activities was S$3.7 million in 1H FY2025. This was mainly due to the dividend paid of S$5.5 million and payment of lease liabilities of S$1.7 million, offset by the proceeds from hire purchase facilities of S$3.5 million.

Commentary On Current Year Prospects

The Group operates in a business environment that remains challenging and uncertain, weighed down by geopolitical tensions, persistent cost pressures, supply chain disruptions, and volatile foreign exchange rates. Market volatility is expected to continue, particularly due to lingering impacts from the global tariff uncertainties.

Nevertheless, the Group maintains a positive outlook for its Singapore operations, supported by ongoing public and private sector construction and infrastructure projects.

The Group will continue to adopt a prudent cash management approach while actively seeking new opportunities aligned with its long-term strategic goals.